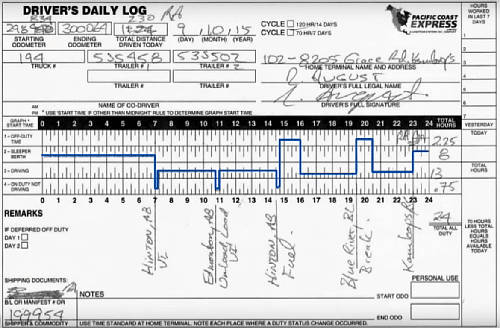

The log book is a legal document & can save you money.

Introduction

Hi there smart drivers, Rick with Smart Drive Test.

Another quick tip for log book smart.

Today we're talking about the log book as a legal document.

And the reason that you sign and print your name on the document is because it is in fact a legal document.

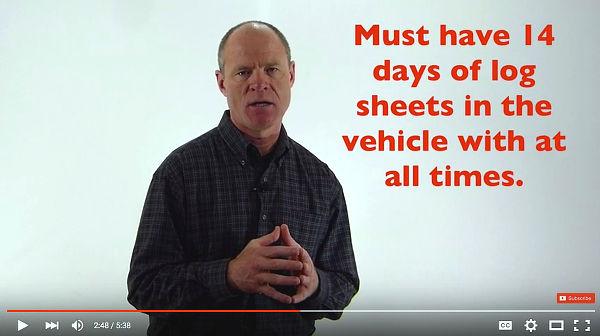

Don't Work the Day for Free:: DOT Weigh Scale Checklist |

||

• DID YOU KNOW? :: Bus & truck drivers are the only drivers that have their own police force (DOT, CVSE, MTO, etc.);• SMART :: There's a lot of paperwork you must produce for authorities at the weigh scale;• SELF-CONFIDENCE :: Bring all paperwork in one hit & impress the diesel bears! |

||

Because in most cases, it's you that gets the fine...NOT the company! |

Post-Crash Investigation

So therefore, if you are unfortunate enough to be involved in a crash or some other incident that requires public attention and authorities investigate you, they will look at your logbook.

For example, if you go down a hill and use a runaway lane or get into a crash and cause property damage or injure someone - they will look at your logbook to ensure that you did a pre-hill safety check before you went down the hill.

And you need to flag that-- put that in your log book.

That way you have done due diligence as part and parcel of your job as a commercial driver.

And I'll put a card up here for you for the video on flagging.

So you can see that and know how to do that.

Taxes - Saving You Money $$

The other thing about the logbook, just quickly, as a legal document, you can use it for tax purposes.

The IRS and the CRA in Canada--the Canada Revenue Agency and the Internal Revenue Services in the United States--both will look at your logbook to calculate your per diem.

For truck drivers and bus drivers working over the road and our away from home for days at a time you are able to use, for tax purposes, a per diem.

A per diem is essentially you're able to claim a certain amount of money for living away from home expenses - meals, lodgings and that sorts of thing.

And if you're not familiar with that, get a good bookkeeper, get a good accountant, who are familiar with taxes in relation to long-haul truck and bus drivers.

So log book - it's a legal document used for crash investigation and used for tax purposes, both in Canada and the United States by the IRS or the CRA.

So sign your document, make sure it's filled out correctly because it is a legal document and you're stating that in fact it's true.

I'm Rick with Smart Drive Test.

Thanks very much for watching.

If you like what you see here share, subscribe, leave a comment down in the comment section - all that helps us out.

As well, hit that thumbs up button.

Check out the videos below, especially if you're embarking on getting your CDL license.

All that will help you be successful in earning your license.

And as well, the videos are great for people endeavouring to work as a bus or truck driver.

Lots of great information to be successful in your day-to-day tasks of carrying out and doing that work.

For those of you on a mobile device, check out the cards in the upper right-hand corner here.

Those too give you links to the videos.

Question for my smart drivers:

Did you know about the per diem and the living away from home expenses for the purposes of taxes and that you had to keep your logbooks?

If you did, leave a comment down in the comment section, all that helps out the new drivers who are entering the industry to know about taxes and what they need to do and keep for the purposes of filing your taxes at the end of the year, either with the CRA or with the IRS.

Thanks very much for watching - good luck on your road test.

Remember, pick the best answer, not necessarily the right answer.

Have a great day.

Bye now.